Institutional-Grade African Commodity Investment—Proven Performance Since 2012

13 years of operational excellence connecting financial institutions, international buyers, and African producers through exclusive market access, comprehensive risk mitigation, and proven logistics networks.

Proven Performance in African Commodity Markets

Since 2012, Tesia Ventures has executed over $500 million in African commodity transactions with a zero-default track record. Our current copper cathode trading operation generates $209.76 million annually, delivering 65.22% ROI through institutional-grade risk management and exclusive producer relationships. When financial institutions and international buyers need reliable African commodity access, they choose the firm with 13 years of flawless execution.

Institutional-Grade Risk Management You Can Trust

Tesia Ventures eliminates African commodity risk through multi-layered institutional safeguards: $25 million in political risk and trade credit insurance, independent SGS collateral management, performance bonds from all counterparties, and Basel III-compliant transaction structures. Our frameworks satisfy the most conservative risk committees while delivering exceptional returns. Every transaction includes comprehensive OECD due diligence, FCPA compliance, and conflict minerals verification.

Insurance Coverage

$25M+ political risk & trade credit protection

Independent Oversight

SGS & Alex Stewart collateral management

Performance Bonds

All counterparties bonded for compliance

Regulatory Compliance

OFAC, FCPA, OECD, AML-CFT adherence

Exclusive Access to Premium African Producers

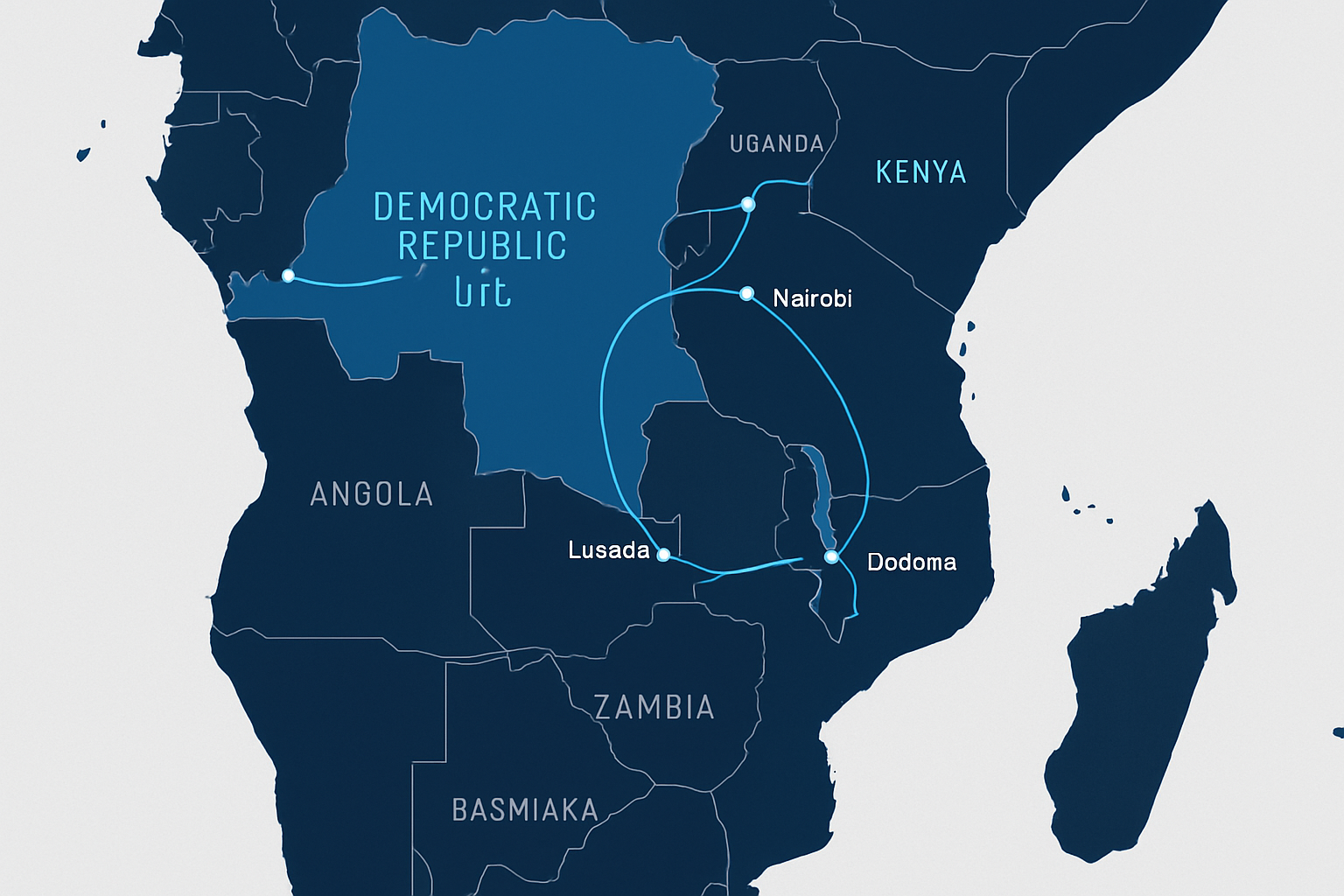

Relationships matter in African commodity markets. Over 13 years, Tesia Ventures has built direct partnerships with premium producers across East, Central, and Southern Africa that competitors cannot replicate. We control proven logistics corridors including the DRC-Tanzania-Zambia route with alternative routing capabilities. Our government relationships and market intelligence provide clients first access to high-quality supply at competitive pricing backed by guaranteed monthly volumes.

Direct Producer Relationships

13+ years of partnership building

Proven Logistics Networks

Multiple routing options, contingency planning

Government Relations

Established connections with mining authorities

Comprehensive Services Across the Value Chain

Tesia Ventures delivers end-to-end African commodity solutions: Project Finance Advisory for transaction structuring and capital raising; Commodity Trading & Intermediation specializing in copper cathode with expansion into strategic minerals; Business Development Services for market entry and partnership facilitation; and Risk Management & Trade Finance including LC structuring and insurance coordination. One partner for the complete African commodity lifecycle.

Project Finance Advisory

Structuring complex international financing for African commodity and infrastructure projects

Learn More →Commodity Trading & Intermediation

Premium copper cathode trading with institutional-grade risk management and guaranteed supply

Learn More →Business Development Services

African market entry strategy, partnership facilitation, and relationship management

Learn More →Risk Management & Trade Finance

Multi-layered risk frameworks, insurance coordination, and regulatory compliance

Learn More →Current Operations: $209.76M Copper Cathode Program

Our active copper cathode trading operation demonstrates Tesia Ventures' execution capability: 2,000 metric tons monthly from premium DRC producers to creditworthy USA buyers, delivering 99.97% Cu purity at 8% LME discount. The program generates $17.48 million monthly revenue with 6.5% gross margin through optimized back-to-back Letter of Credit structures. This operation serves as our platform for expansion into cobalt, lithium, and rare earth minerals.

Who We Serve—And How We Create Value

Financial Institutions

Exceptional risk-adjusted returns with comprehensive downside protection. Our institutional-grade frameworks satisfy conservative credit committees while delivering 65% ROI on deployed capital.

Commodity Buyers

Guaranteed supply of 99.97% purity copper at 8% LME discount. Eliminate production disruptions with monthly volume commitments backed by proven logistics and quality assurance.

African Producers

Secure market access with creditworthy international buyers. LC-backed payment guarantees eliminate counterparty risk. Fair LME-linked pricing and professional export support.

Ready to Explore African Commodity Opportunities?

Discover how Tesia Ventures delivers exceptional value through exclusive market access, institutional-grade protection, and proven operational excellence.